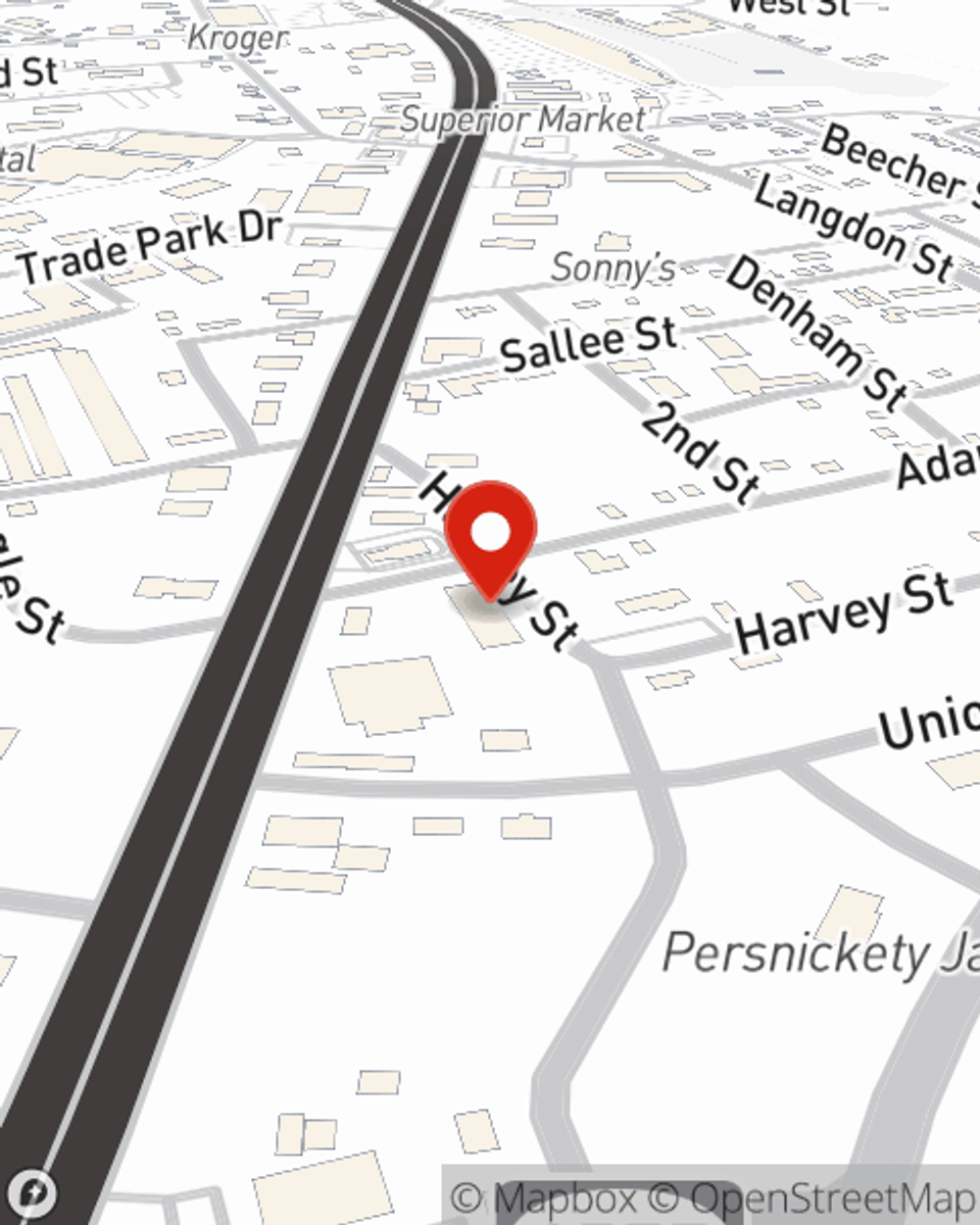

Homeowners Insurance in and around Somerset

Somerset, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

- Somerset

- Science Hill

- Eubank

- Nancy

- Pulaski County

- Burnside

- Bronston

- Shopville

- Lake Cumberland

- Conley Bottom

- Waynesburg

- State Dock

- Burnside Marina

- Crab Orchard

- Tateville

- Woodson Bend

There’s No Place Like Home

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you unwind, catch your breath and rest. It’s where you build a life with family and friends.

Somerset, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Protect Your Home With Insurance From State Farm

Your home is the cornerstone for the life you cherish. That’s why you need State Farm homeowners insurance, just in case trouble comes knocking. Agent Kevin Stewart can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Kevin Stewart, with a no-nonsense experience to get high-quality coverage for your homeowner insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

Whether you're prepared for it or not, the accidental can happen. But with State Farm, you're always prepared, so you can laugh and play knowing that your belongings are protected. Additionally, if you also insure your car, you could bundle and save! Contact agent Kevin Stewart today to go over your options.

Have More Questions About Homeowners Insurance?

Call Kevin at (606) 678-4056 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.

Kevin Stewart

State Farm® Insurance AgentSimple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.